Articles + Publications May 7, 2024

Locke Lord QuickStudy: Floating on Both Coasts: Gulf of Maine and Oregon Proposed Sale Notices Are a Study in Contrasts

Locke Lord LLP

If the offshore wind industry is going to come close to meeting the Biden Administration’s goal of deploying 15 GW for floating wind by 2035, it’s going to require a lot of turbines spinning in the Gulf of Maine and off a sparsely populated stretch of the Oregon coast. The Bureau of Ocean Energy Management took a major step on both fronts last week by issuing proposed sale notices (PSNs) for each of these areas and soliciting public comment in advance of anticipated October auctions.

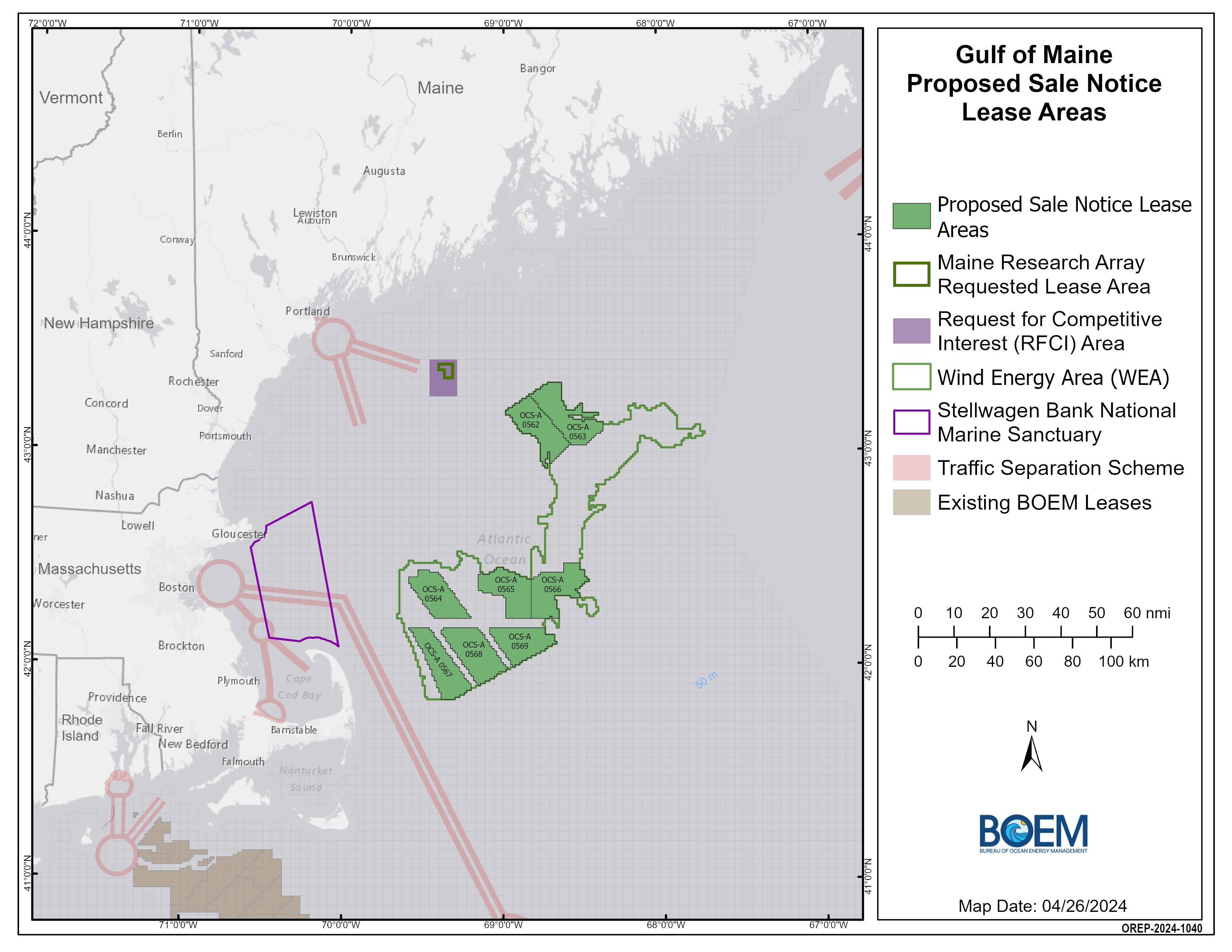

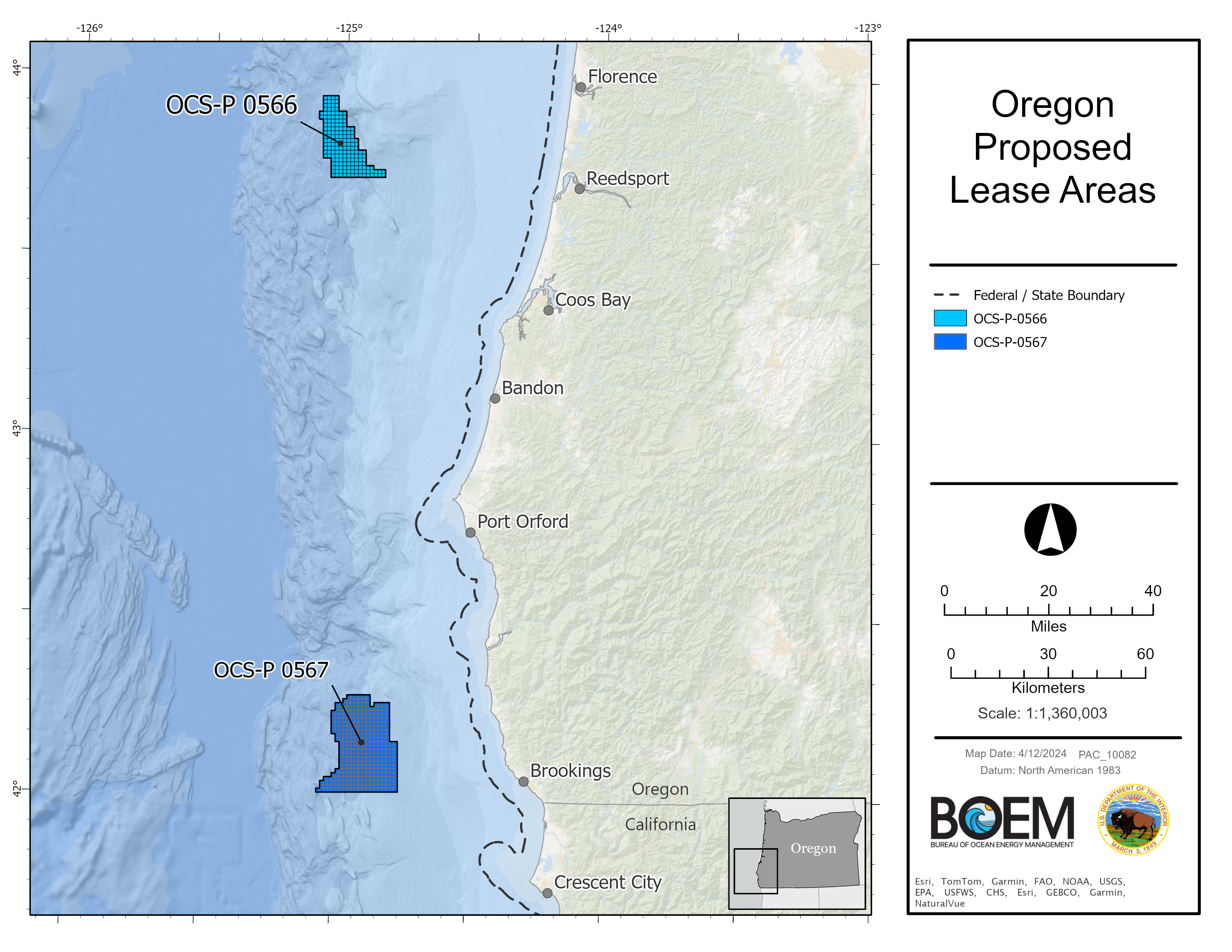

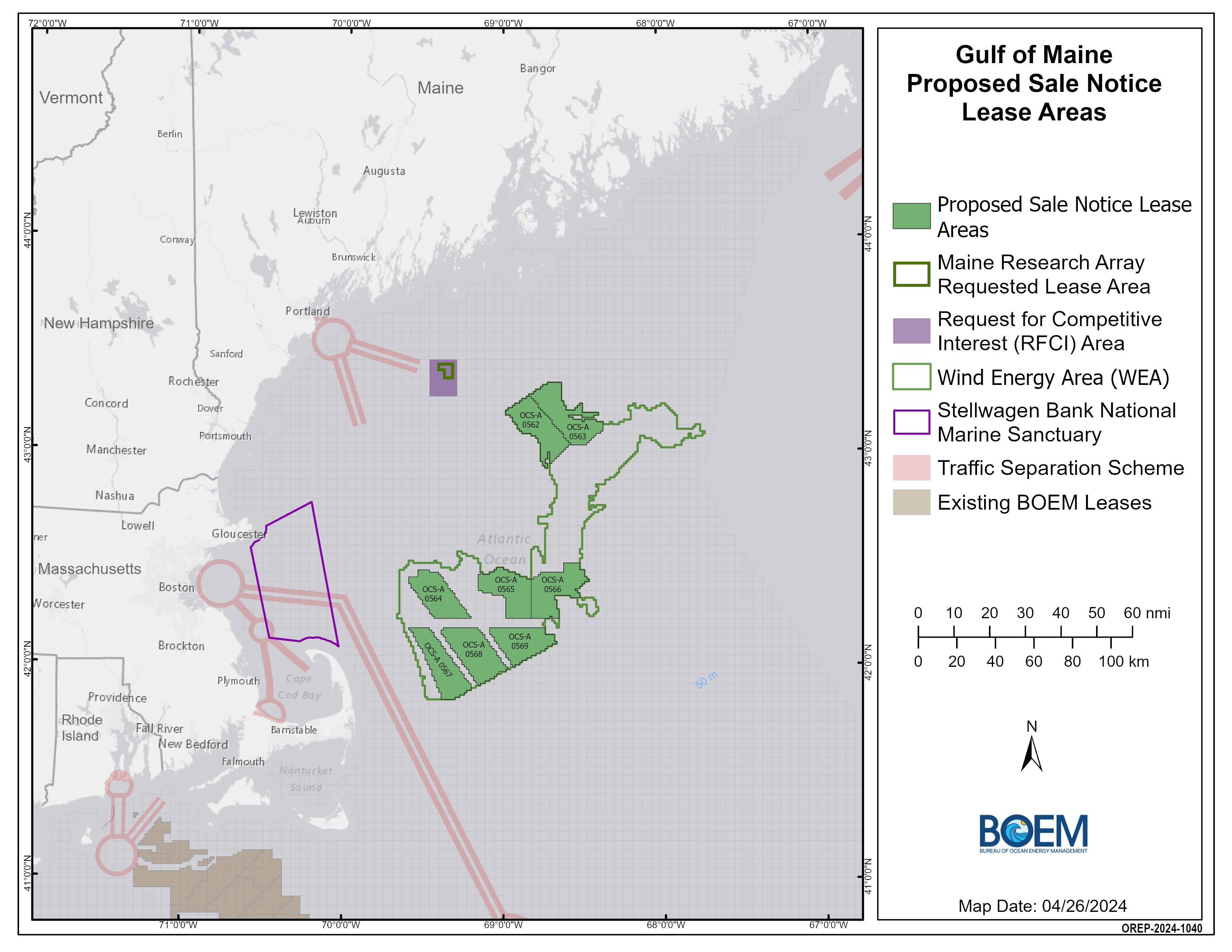

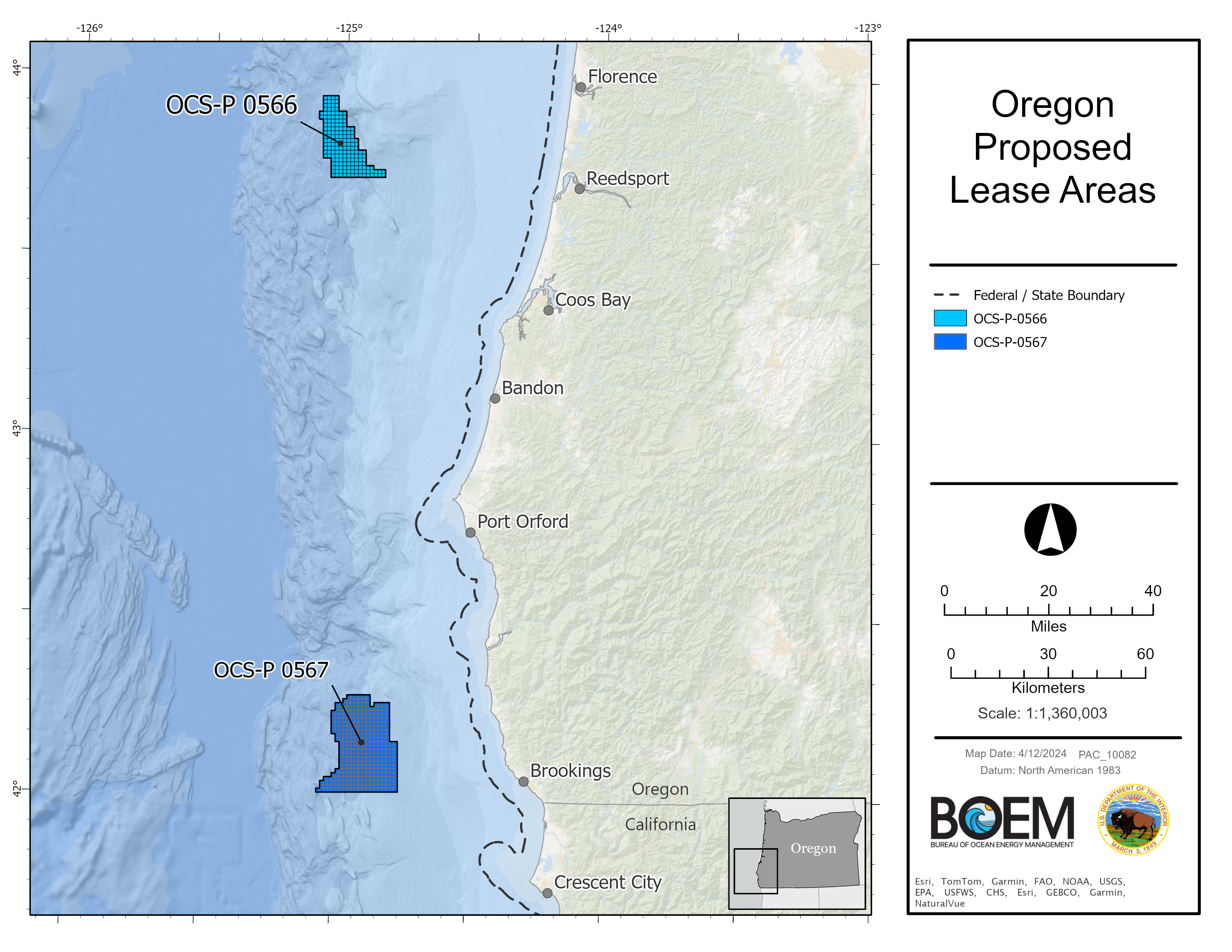

These two regions are tied together by more than just imminent floating wind lease sales. Both have deep waters off their shores, strong wind speeds that create high potential for energy generation, unified Democratic control of their respective state governments, and vocal local opposition driven largely by commercial fishing industries. Additionally, both areas have also been the subject of intensive BOEM outreach to the public and key stakeholders. Yet one of them, the Gulf of Maine auction, is poised to be the largest ever in terms of both acres and numbers of leases: 8 leases, each between 106,000 and 134,000 acres, for a total of over one million acres. Meanwhile, the other sale off of Oregon would represent the smallest number of acres BOEM has put up for sale: 2 leases of approximately 61,000 and 134,000 acres, respectively.

So what accounts for this stark difference, and what does this tell us about the drivers of the U.S. offshore wind industry?

The most salient answer is that state political support is a key determinant of whether and how much BOEM leases in a given area—especially when that support is backed by binding commitments to procure offshore wind. It is no accident that most of the proposed leases in the Gulf of Maine are close to the coast of Massachusetts, one of the earliest and most steadfast supporters of offshore wind. Massachusetts currently has a mandate to contract for 5.6 GW of offshore wind by 2027, which will almost certainty be drawn from existing leases off its southern coast. But it has a longer-term goal of receiving 10 GW of energy from the Gulf of Maine,[1] and it is generally assumed that the state legislature will eventually make this goal legally binding. Last year Maine passed a law, L.D. 1895, directing the state to procure up to 3 GW of offshore wind by 2040. BOEM explicitly cited these combined targets in its Gulf of Maine PSN.

By contrast, Oregon has not yet provided a path to market for offshore wind. Oregon House Bill 3375, passed in 2021, created a goal for the development of up to 3 GW of floating wind by 2030, but rather than mandating that the state attain that goal, the law simply directed the Oregon Department of Energy (ODOE) to conduct a study and report its findings. Governor Tina Kotek and the Oregon General Assembly have since passed House Bill 4080 requiring the development of an offshore wind road map, but this law likewise contained no guaranteed path to market and instead imposes a suite of procedural obligations on potential developers. Without a state mandate pushing BOEM to lease more acres and spark commercial interest, and with many coastal residents pushing in the other direction, it is perhaps remarkable that BOEM is proposing an Oregon lease sale at all, irrespective of its size.

Geography and marine spatial planning also play a key role in determining the size of a lease sale. BOEM started its Gulf of Maine leasing process by soliciting comments on a Call Area that encompassed nearly the entire region,[2] allowing it to make significant concessions to other agencies and ocean users (e.g., commercial fishermen, navigational concerns, sensitive benthic habitats) while still maintaining robust acreage at each subsequent stage. In Oregon, meanwhile, BOEM planners focused on the South Coast of Oregon early in their process, where they were limited by a steep drop-off in water depths beyond which even floating development became much more costly and technically difficult. This gave BOEM less flexibility to consider new areas when the Coos Bay Call Area was drastically reduced by an unanticipated and late-breaking national security conflict.[3]

While the big picture for the Gulf of Maine and Oregon coast looks quite different, the particulars of the PSNs are similar, and neither deviates significantly from other recent offshore wind sale notices—with some exceptions.

The Gulf of Maine PSN is notable in several key respects:

- BOEM proposes that bidders be limited to acquiring no more than two of the eight leases intended to be put up for auction. This would represent a middle ground between the one-lease-per bidder rule that BOEM has maintained for all of its offshore wind sales since 2015 and its proposal to set no limits for the second Gulf of Mexico wind sale planned for later this year.

- BOEM proposes a 12.5% bidding credit for payment into a fisheries compensation fund, which is larger than similar proposed credits in other recent sales. While this credit represents a major opportunity to build bridges between the offshore wind and commercial fishing industries, there appears to be inconsistency between BOEM’s proposal and the ongoing effort to establish an 11-state regional fisheries fund across the entire East Coast. This is in large part because as proposed by BOEM, the bidding credit could only be used to compensate fishermen in the Gulf of Maine, whereas the proposed 11-state fund would be used to compensate fishermen adversely affected by wind farms between Maine and North Carolina.

- An additional 12.5% bidding credit would be set aside to spend on workforce training or supply chain development specific to floating wind. Other than the focus on floating wind, this credit appears to be very similar to the workforce/supply chain credit that has been offered—in varying percentages—in every BOEM offshore wind sale since 2022. The PSN provides detailed guidance on eligible uses of this bidding credit, including union apprenticeships, maritime training for vessel crewing, technical assistance grants to help U.S. manufacturers retool or certify for floating wind, development of U.S.-flagged vessels, and development of port infrastructure.

- BOEM proposes that both bidding credits be spent by the earlier of the lessee’s submission of its facility design report (FDR) or the fifth anniversary of execution of the lease.

- BOEM also seeks comment on a potential new lease stipulation that would require lessees to “conduct baseline data collection activities for endangered and threatened marine mammals and their habitats in support of developing their construction and operations plans (COPs).” This stipulation appears to be redundant of BOEM’s current regulations regarding COP data.[4]

The Oregon PSN resembles BOEM’s Pacific Region’s approach in its 2022 California lease sale, with some key differences:

- BOEM would allow each bidder to win only one of the two leases.

- The proposed bidding credits are virtually identical to what was offered in California.

- 15% bidding credit for workforce training or supply chain development, a slight increase from what is also being proposed in the Gulf of Maine.

- 5% credit for entering into a community benefits agreement (CBA) with a community or stakeholder group that uses or harvests resources from the geographic space of the lease area—most likely commercial or subsistence fishermen.

- 5% credit for a CBA with any other “community or stakeholder group that is expected to be impacted by the lessee’s potential floating offshore wind development.” This could include Tribal nations or coastal communities.

- While the California supply chain/workforce bidding credit was 20% and the CBA credits were each 5% (for a total of 30% credits), the total dollar value of the Oregon credits is actually slightly higher than in California because BOEM has simplified the way its bidding credits are calculated.

- BOEM proposes that these bidding credits be spent (or the obligations fulfilled) no later than FDR submittal or the tenth anniversary of lease execution—twice as long as the Gulf of Maine PSN’s proposal. This longer timeline indicates that BOEM anticipates there will be a significant gap in the timelines for commercial development of the Gulf of Maine and Oregon.

For questions regarding Gulf of Main and Oregon PSNs, or to discuss the outlook for offshore wind in these areas, please contact the authors.

—

[4] 30 CFR 585.626(a)(3).

Insight Industries + Practices

Sponsored Events

New York Intellectual Property Law Association’s (NYIPLA) 104rd Annual Dinner in Honor of the Federal Judiciary

March 27, 2026 | 6:30 PM – 10:00 PM ET

New York Hilton Midtown

1335 6th Ave, New York, NY 10019

Speaking Engagements

UNC Banking Institute

March 25 – 27, 2026

The Ritz-Carlton, Charlotte

201 E Trade St., Charlotte, NC 28202

Firm Events

Cross Border Life Sciences Distribution Agreements: A Trade Compliance Playbook

March 18, 2026 | 12:00 PM – 1:00 PM ET

Virtual

Webinars

Foreign Private Issuers’ D&Os Now Subject to Sec. 16(a) Insider Reporting: Compliance Burdens, Timing, Practical Implications

March 17, 2026 | 1:00 PM – 2:30 PM ET

Virtual