Articles + Publications June 6, 2024

A Closer Look at Feds’ Proposed Banker Compensation Rule

Published in Law360 on June 6, 2024. © Copyright 2024, Portfolio Media, Inc., publisher of Law360. Reprinted here with permission.

On May 6, the Federal Deposit Insurance Corp., Office of the Comptroller of the Currency and Federal Housing Finance Agency issued a notice of proposed rulemaking and request for public comment to implement Section 956 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.[1]

Under Section 956, the FDIC, OCC, FHFA, National Credit Union Association, U.S. Securities and Exchange Commission, and Board of Governors of the Federal Reserve System are tasked with jointly prescribing regulations (1) prohibiting covered financial institutions from awarding incentive-based compensation that promotes inappropriate risk-taking because it is excessive or could result in material financial loss and (2) obligating the covered financial institutions to disclose, to the appropriate federal regulator, information concerning these compensation arrangements.

The expectation is that the National Credit Union Association will act on the proposed rule soon, and practitioners anticipate that the SEC will follow suit. However, there is significant doubt as to whether the Fed will join the other regulators at this time.

At a House Financial Services Committee hearing on March 6, Rep. Rashida Tlaib, D-Mich., pressed Fed Chair Jerome Powell on whether the Fed would “commit to helping finalize the Dodd-Frank section of 956 this year.”[2] Powell responded, “I would like to understand the problem we’re solving, and then I would like to see a proposal that addresses that problem.”[3]

Importantly, the proposed rule cannot progress through the rulemaking process unless and until it is proposed by all six regulators.

Background

Dodd-Frank was enacted in 2010 in the wake of the 2008 financial crisis, with sweeping measures aimed at protecting the American public from practices that were viewed as having contributed to the financial crisis.

Dodd-Frank sought to create guardrails around executive compensation by, among other things, requiring recoupment of incentive compensation received by executives resulting from faulty financials; mandating more robust disclosures to shareholders regarding executive compensation; and, under Section 956, reining in incentive-based compensation practices that were seen as promoting overly risky behavior at financial institutions.

Regulations to enforce Section 956 were initially proposed jointly by all the relevant regulators in 2011, and updated regulations were proposed in 2016. The current notice of proposed rulemaking includes the same rule text that was put forth in 2016, while also exploring potential alternatives to certain provisions.

In the current notice, the participating regulators request renewed review and public commentary on the entirety of the proposal, given the passage of time, intervening developments and industry changes over the past eight years.

Covered Institutions

The following types of institutions that have at least $1 billion in assets — depository institutions and their holding companies, broker-dealers, credit unions, investment advisers, Fannie Mae and Freddie Mac, and other financial institutions as determined in the regulators’ discretion — are considered covered financial institutions under the statute.

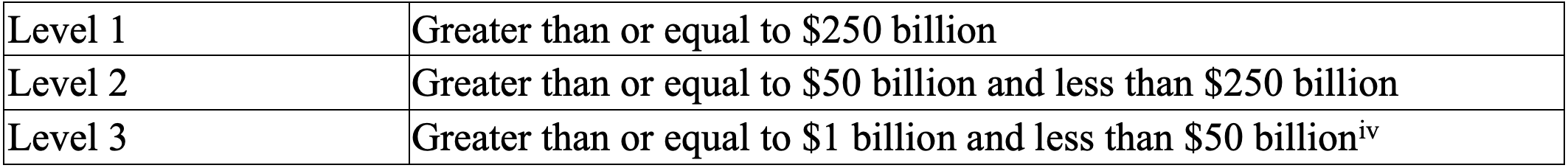

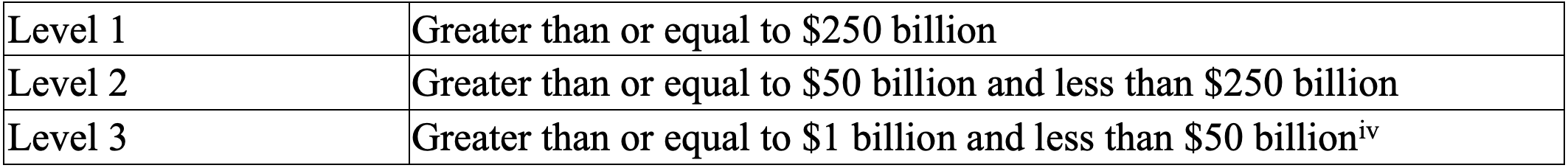

Covered financial institutions are further broken down into three tiers in the proposed regulation, based on the value of the entity’s assets, with more stringent requirements applying to Level 1 and 2 entities:

Covered Individuals

The term “covered person” under Section 956 generally applies to executive officers, employees, directors and principal shareholders — 10% holders or more — who earn incentive-based compensation from a covered institution. Additional rules apply to covered persons at a Level 1 or 2 institution who are senior executive officers or significant risk-takers.

Senior executive officers generally include those who have the title of, or function as, “president, chief executive officer, executive chairman, chief operating officer, chief financial officer, chief investment officer, chief legal officer, chief lending officer, chief risk officer, chief compliance officer, chief audit executive, chief credit officer, chief accounting officer, or head of a major business line or control function.”[4]

Significant risk-takers generally include nonsenior executives whose compensation is at least one-third incentive-based and who either (1) are among the top 2%-5% — depending on whether the institution is Level 1 or 2 — of the highest compensated nonsenior executive covered persons at the relevant institution, or (2) have the authority to commit or expose at least 0.5% of the institution’s capital.

Regulated Compensation

The proposed rule regulates “incentive-based compensation,” which is defined broadly as “any variable compensation, fees or benefits that serve as an incentive or reward for performance.”[5]

According to the proposed regulation, incentive-based compensation should not encourage inappropriate risk-taking by covered individuals, either by being excessive or by being designed in a way that could lead to material financial loss.

The proposed rule states that incentive-based compensation is considered excessive when amounts paid are “unreasonable or disproportionate to the value of the services performed”[6] by the individual, taking into account the following nonexhaustive factors enumerated in the proposed regulation:

-

The total value of all compensation and benefits provided to the individual;

-

The compensation history of the individual and relevant benchmarking of individuals with the same expertise at comparable entities;

-

The institution’s financial condition;

-

Compensation practices at peer entities;

-

The projected cost of post-employment benefits, if applicable; and

-

Fraud, breach of fiduciary duty or insider abuse by the individual.

To avoid encouraging inappropriate risks that could lead to a material financial loss, incentive-based compensation must balance risk and reward, be compatible with sound risk management, and be backed by strong corporate governance, according to the proposed regulation.

To appropriately balance risk and reward, the proposed regulation provides that an incentive-based compensation arrangement must include both financial and nonfinancial performance measures, provide a mechanism for nonfinancial measures to override financial measures in appropriate circumstances, and allow for award adjustments in the case of losses, inappropriate risk-taking and compliance failures.

The proposed rule contains a grandfathering provision, which ensures that incentive-based compensation plans whose performance periods begin prior to the date on which a covered institution is required to comply with the regulation are grandfathered and not subject to the regulation.

Additional Limitations

Incentive-based compensation arrangements provided to senior executive officers and significant risk-takers at Level 1 and 2 covered institutions, as well as any Level 3 institution that the applicable regulator deems should be subject to the strictures applied to Level 1 or 2 institutions, are subject to the following additional requirements under the proposed rule.

Cap on Incentive-Based Compensation

No incentive-based compensation award may be made in excess of 125% for senior executive officers, or 150% for significant risk-takers, of the target amount for such award.

Minimum Vesting Period

Between 40% and 60% of a senior executive officer’s or significant risk-taker’s incentive-based compensation must be subject to minimum vesting after performance conditions are fulfilled.

- For incentive-based compensation with a performance period of less than three years, the minimum subsequent vesting period is three years for Level 2 or four years for Level 1.

- For incentive-based compensation with a performance period equal to at least three years, referred to as a long-term incentive, the minimum subsequent vesting period is two years for Level 1 or one year for Level 2.

- During the minimum vesting period, amounts may not vest sooner than on a pro rata annual basis, with the first tranche vesting no earlier than the first anniversary of the date the relevant performance period ended. Accelerated vesting is not permitted, except upon a covered individual’s death or disability.

- Incentive-based compensation subject to these minimum vesting requirements needs to include a mix of both cash and equity-based awards. The total amount of incentive-based options or similar instruments such as stock appreciation rights that may be used to meet the minimum vesting requirement is capped at 15% of the covered individual’s incentive-based compensation for the relevant performance period.

Forfeiture and Downward Adjustment

Upon the occurrence of one of the following events, a financial institution must consider whether forfeiture or downward adjustment is appropriate with respect to incentive-based compensation of a senior executive officer or significant risk-taker with responsibility related to such event:

- Poor financial performance at the institution due to significant noncompliance with the institution’s risk policies;

- Risk-taking that is considered inappropriate, whether or not it affected the institution’s financial performance;

- Material failures in risk management;

- Failure to comply with laws, resulting in an enforcement action or a requirement to restate financials; or

- Another type of misconduct or unacceptable performance.

Clawback

In addition to any other clawback policies maintained by the institution, the proposed regulation would require that covered institutions be allowed to claw back incentive-based compensation arrangements for current and former senior executive officers or significant risk-takers for seven years following vesting if the individual engages in misconduct that causes significant financial or reputational harm to the institution, fraud or intentional misrepresentation of the information used to set their own incentive-based compensation.

Note that this clawback requirement focuses on the covered individual’s misconduct, whereas the separate clawback requirement that applies to public companies under rules implemented in 2023 pursuant to Section 954 of Dodd-Frank[7] is triggered by a restatement of financial statements, whether or not the executive engaged in misconduct.

Other Requirements and Limitations

- Performance measures for incentive-based compensation may not be exclusively based on comparisons to peers, e.g., relative measures such as relative total shareholder return.

- No hedging instrument may be purchased by the institution for a covered individual who would offset a potential loss in the value of their incentive-based compensation.

- Incentive-based compensation arrangements may not be based on transaction revenue or volume alone, but must consider transaction quality and the covered individual’s compliance with risk management.

Documentary Compliance and Governance

In addition to limitations on the award of incentive-based compensation, the proposed regulation imposes robust documentary compliance and governance requirements for covered institutions.

For example, institutions must maintain detailed records regarding incentive-based compensation for seven years and be ready to provide the records to the appropriate federal regulator if requested to do so. Enhanced disclosure, compliance and recordkeeping obligations apply to Level 1 and 2 institutions.

Next Steps

The participating regulators have included specific questions for public consideration on nearly every aspect of the proposed rule within the notice of proposed rulemaking.

In addition, the notice specifically contemplates numerous alternatives to the proposed rule’s current iteration for consideration, including whether Level 1 and 2 institutions should be collapsed into a single category, the appropriate test for determining a significant risk-taker, whether forfeiture and downward adjustments should be mandated or discretionary, and if additional risk management requirements should be imposed.

Although the official comment period on the proposed rule cannot commence until it is published in the Federal Register, which requires approval by all six regulators, participating regulators are separately soliciting comments in the meantime.

Given the necessity for all six regulators to collaborate on the proposed rule, the number of issues under consideration in the most recent notice of proposed rulemaking and the general climate of uncertainty in an election year, the impact that the reproposed regulation will have remains unclear at this time.

[1] Notice of Proposed Rulemaking and Request for Public Comment (May 5, 2024) at: Incentive-based Compensation Arrangements NPR 2024 (fdic.gov) (“Notice”), /https://www.fdic.gov/sites/default/files/2024-05/2024-05-03-fed-reg-incentive-based-compensation-agreements_0.pdf.

[2] House Financial Services Committee Hearing on the Federal Reserve’s Semiannual Monetary Policy Report, March 6, 2024.

[3] Id.

[4] Notice at 97, 127, 155 and 180.

[5] Id. at 93, 124, 153 and 178.

[6] Id. at 103, 133, 158 and 184.

[7] See a description of clawback requirements implemented under Section 954 of Dodd Frank here: https://www.troutman.com/insights/sec-adopts-final-clawback-rules.html.

Insight Industries + Practices

Sponsored Events

New York Intellectual Property Law Association’s (NYIPLA) 104rd Annual Dinner in Honor of the Federal Judiciary

March 27, 2026 | 6:30 PM – 10:00 PM ET

New York Hilton Midtown

1335 6th Ave, New York, NY 10019

Speaking Engagements

UNC Banking Institute

March 25 – 27, 2026

The Ritz-Carlton, Charlotte

201 E Trade St., Charlotte, NC 28202

Firm Events

Cross Border Life Sciences Distribution Agreements: A Trade Compliance Playbook

March 18, 2026 | 12:00 PM – 1:00 PM ET

Virtual

Webinars

Foreign Private Issuers’ D&Os Now Subject to Sec. 16(a) Insider Reporting: Compliance Burdens, Timing, Practical Implications

March 17, 2026 | 1:00 PM – 2:30 PM ET

Virtual