Articles + Publications February 6, 2025

An Early Look at New Proxy Disclosures Regarding Stock Option Grant Timing

This article was republished in INSIGHTS: The Corporate & Securities Law Advisor (Volume 39, Number 4, April 2025).

The primary development in executive compensation disclosure for the 2025 proxy season is new Item 402(x) under Regulation S-K, relating to the disclosure of stock option grant timing policies and practices. Companies with fiscal years ending December 31 are now drafting these disclosures for the first time and are eager to see how other companies have complied with the new rule. This client alert reviews the rule itself, makes a few observations about the early filings, and attaches examples of early Item 402(x)(1) disclosures made by well-known issuers.

A Quick Review of The Rule

To review, Item 402(x) includes both narrative and tabular components.

Narrative Disclosure

First, Item 402(x)(1) requires issuers to provide a narrative disclosure describing their policies and practices regarding the timing of awards of options in relation to their release of material non-public information (MNPI), including:

- How the board or compensation committee determines when to grant such awards (for example, whether the awards are granted on a predetermined schedule);

- Whether (and if so, how) MNPI is taken into account when determining the timing and terms of an award; and

- Whether the company has timed the disclosure of MNPI for the purpose of affecting the value of executive compensation.

For this purpose, the term “option” includes stock options, stock appreciation rights (SARs) and other instruments with option-like features.

Tabular Disclosure

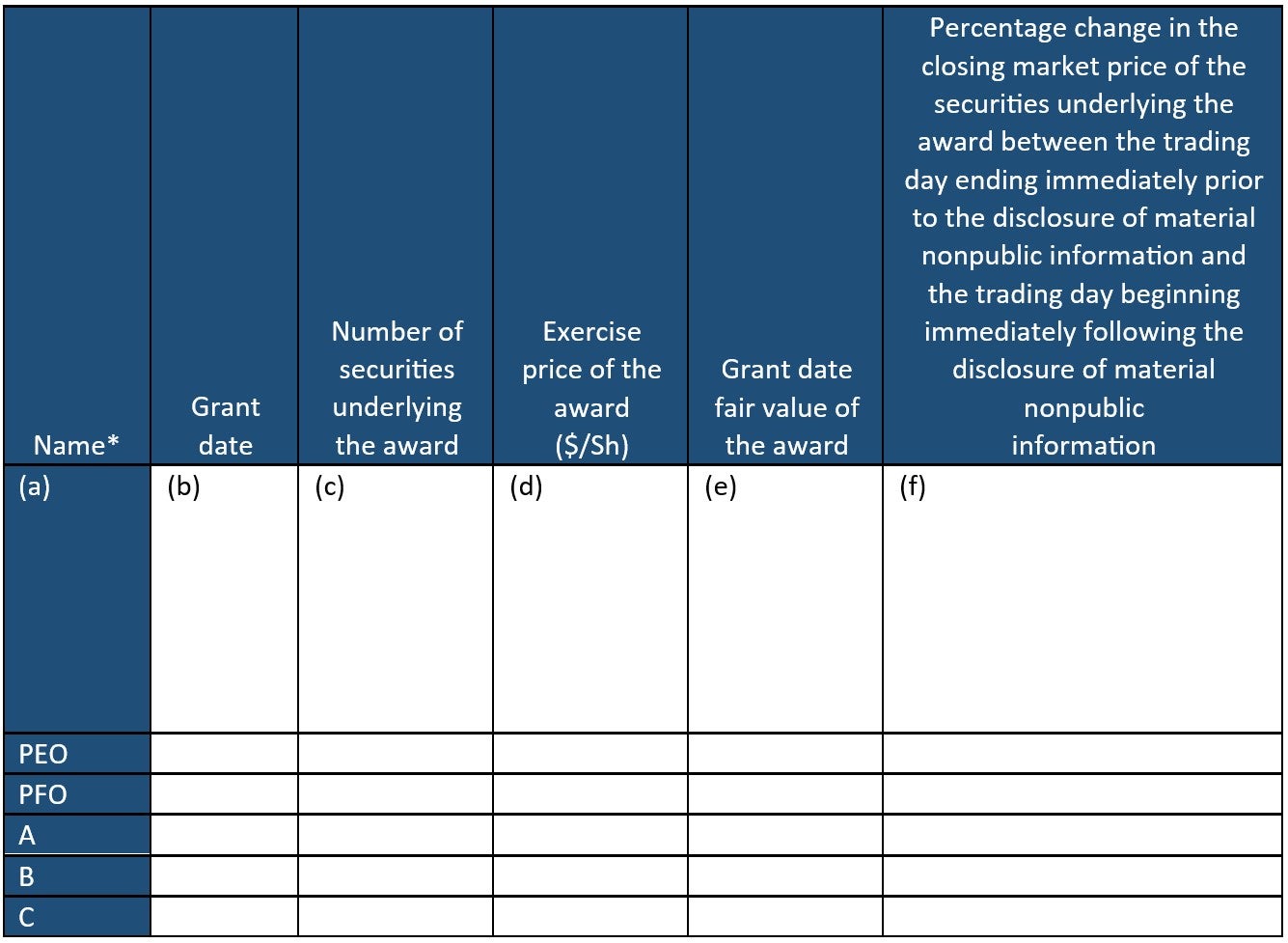

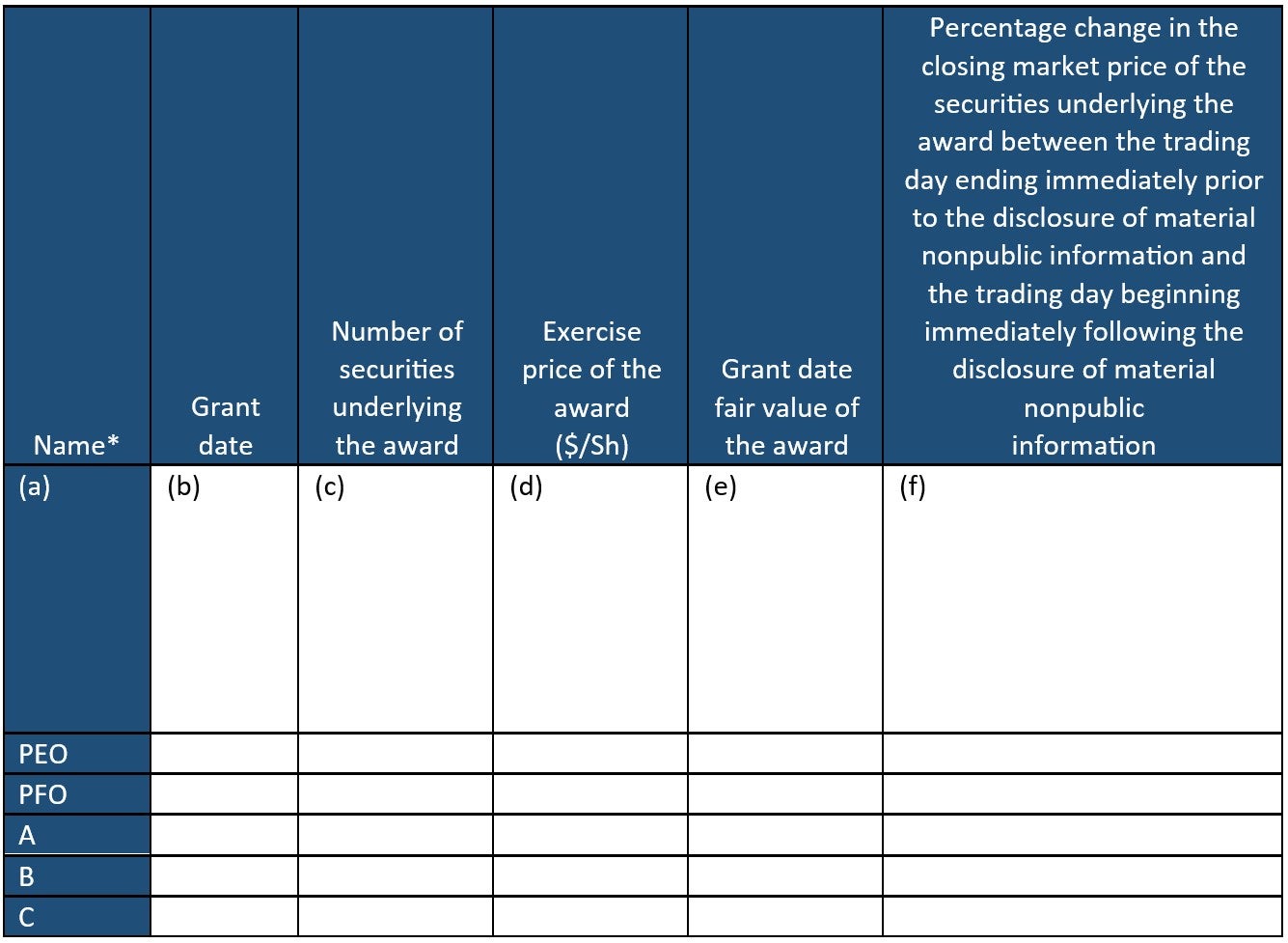

Second, Item 402(x)(2) requires an issuer to make the following tabular disclosure if, during the preceding fiscal year, it has granted an option to a named executive officer (NEO) within four business days before or one business day after the filing of a Form 10-Q, Form 10-K, or a Form 8-K that discloses MNPI (an “MNPI window”):

* This list should be adjusted for each reporting company to reflect the company’s roster of NEOs for a particular year (including a shorter list for smaller reporting companies and emerging growth companies).

For this purpose, an option is deemed granted on its effective date, even if it approved on an earlier date. If no options were granted within an MNPI window, then the table may be omitted.

Item 402(x) disclosures were first required to be included in Form 10-Ks filed for fiscal years ending on or after March 31, 2024 (or for smaller reporting companies, September 30, 2024). However, as permitted by Securities and Exchange Commission (SEC) rules, most companies incorporate Item 402 disclosures by reference to proxy statements filed shortly after their Form 10-K. Therefore, early Item 402(x) disclosures started trickling out last summer.

Early Filings, and a Few Observations

Attached for your reference are early Item 402(x)(1) narrative disclosures from several well-known issuers, which illustrate a range of approaches. We have the following observations and practice pointers based on the rules and early disclosures:

- Who Is Covered? Unlike the Item 402(x)(2) tabular disclosure, the scope of Item 402(x)(1) covers all option grantees, not just NEOs. Most early disclosures appear to be correctly addressing this point.

- What Period Is Covered? Item 402(x)(1) requires that the disclosure address whether the issuer has timed the disclosure of MNPI for the purpose of affecting the value of executive compensation. However, the rule does not indicate the time period covered by this disclosure. On this point, some early disclosures have been limited to the most recently completed fiscal year (see e.g., Visa), which we believe is a reasonable approach. Other issuers avoid the question by using artful language and, rather than stating that the issuer has never timed the disclosure of MNPI for the purpose of affecting the value of executive compensation, state that it is not the issuer’s practice to do so (see e.g., Estee Lauder).

- Silence Is Not an Option, Even if You Don’t Grant Options. Even issuers that do not grant options should not omit the 402(x)(1) disclosure altogether. Such an issuer must still indicate whether it has a policy or practice regarding option grant timing. If true, it would be appropriate to disclose that the issuer has no such policy or practice, because it does not grant (or has not in recent years granted) options.

- What Grants Are Covered? Item 402(x) only covers stock options (and similar instruments, like SARs) and some issuers have limited their disclosures accordingly (see e.g., Estee Lauder). However, many issuers (see e.g., Apple, Deere, Intuit, Visa) use the disclosure to explain their grant policies or practices with respect to all equity award types. We expect the latter approach to become very common, because for the many issuers granting exclusively restricted stock units and performance-based restricted stock units, saying that you have no policy or practice regarding the timing of option grants (see #3 above) begs the question of what your policy or practice is for other award types.

- Where Does the Disclosure Appear? Some early filers have placed their Item 402(x)(1) narrative disclosures outside the Compensation Discussion and Analysis (CD&A). Others have included the 402(x)(1) disclosure within their CD&As (see e.g., Apple, Visa). While either approach is acceptable, we prefer the CD&A placement given long-standing SEC rules that include equity award timing among the illustrative list of items that could warrant discussion in the CD&A (see Item 402(b)(2)(iv)).

- Will Most Option Issuers Disclose That They Have Policies or Practices Governing the Timing of Option Grants? Although Visa is the only issuer in the examples below that discloses a formal policy regarding equity award timing, all the issuers indicate that they have consistent practices governing option or equity award timing, and all work hard to describe their practices as consistent with good governance standards. In this regard, Item 402(x) is having its intended effect. The SEC was not in a position to prohibit option grants during MNPI windows. Indeed, such grants are generally lawful (although do have accounting consequences and raise fiduciary considerations). Nonetheless, the SEC was troubled by the practice and promulgated Item 402(x) to name and shame issuers into avoiding it. Early indications suggest that most issuers are quickly falling into line.

- Will Item 402(x)(2) Tabular Disclosures be Common? As a corollary to #6 above, issuers have become increasingly conscious about scheduling their compensation committee meetings (or the effective dates of their option grants) to avoid making option grants during an MNPI window. While such grants will still occur on occasion, the Item 402(x)(2) tabular disclosure obligation is enough to discourage them in most cases.

- Caution Is Required. If, like most other issuers, you intend to write your Item 402(x)(1) narrative disclosure to describe your equity grant practices as following good governance standards, don’t oversell it. Issuers can often say (for example) that their compensation committee meetings are scheduled far in advance and generally occur after earnings are announced, and that they do not time the disclosure of MNPI for the purpose of affecting the value of executive compensation. But despite standard practices that reduce the likelihood that grants will be made when MNPI exists, such grants may nonetheless occur for a variety of reasons. For example, an issuer may consider it necessary or appropriate to grant equity to a newly hired senior executive immediately upon his or her start date. In such cases, issuers need to be able to show that the grants did not violate the practices they articulated. Moreover, to demonstrate responsible exercise of fiduciary duties in such cases, issuers may need to say that their compensation committees DID take the anticipated effects of the MNPI into account when sizing the grants.

***

To discuss your equity grant timing practices or related proxy disclosures, please contact any of the authors of this client alert or your regular Troutman Pepper Locke contact.

Early Filers

Apple 2025 Proxy Statement, Page 54:

Equity awards are discretionary and are generally granted to our named executive officers on the first day of the applicable fiscal year. In certain circumstances, including the hiring or promotion of an officer, the People and Compensation Committee may approve grants to be effective at other times. Apple does not currently grant stock options to its employees. Eligible employees, including our named executive officers, may voluntarily enroll in the ESPP and receive an option to purchase shares at a discount using payroll deductions accumulated during the prior six-month period. Purchase dates under the ESPP are generally the last trading day in July and January. The People and Compensation Committee did not take material nonpublic information into account when determining the timing and terms of equity awards in 2024, and Apple does not time the disclosure of material nonpublic information for the purpose of affecting the value of executive compensation.

Deere & Co. 2025 Proxy Statement, Page 85:

We provide the following discussion of the timing of option awards in relation to the disclosure of material nonpublic information, as required by Item 402(x) of Regulation S-K. The Company’s long-standing practice has been to grant LTI equity awards on a predetermined schedule. At the first quarterly meeting of any new fiscal year, the Committee or, with respect to the CEO’s equity award, the Board, reviews and approves the value and amount of the equity compensation to be awarded (inclusive of RSUs, PSUs, and stock options) to executive officers. The grant of approved equity awards then occurs a week after the Board’s first quarterly meeting. The first quarterly meeting of the Board typically occurs after the Company’s release of the financial results for the prior fiscal year through the filing of a Current Report on Form 8-K and accompanying earnings release and earnings call, but before the filing of the Company’s Annual Report on Form 10-K for that fiscal year.

The Committee does not take material nonpublic information into account when determining the timing and terms of LTI equity awards. Instead, the timing of grants is in accordance with the yearly compensation cycle, with awards granted at the start of the new fiscal year to incentivize the executives to deliver on the Company’s strategic objectives for the new fiscal year.

The Company has not timed the disclosure of material nonpublic information to affect the value of executive compensation. Any coordination between a grant and the release of information that could be expected to affect such grant’s value is precluded by the predetermined schedule. Over the last three years, the average percentage change in the value of the Company’s common stock from the last trading day before the filing of the Company’s Annual Report on Form 10-K to the trading day immediately following such filing is 0.91%, demonstrating that the release of the Company’s Annual Report on Form 10-K, and any material nonpublic information contained therein, does not meaningfully influence the Company’s stock price, and by extension, the value of stock options or other LTI equity awards at the time of grant.

Estee Lauder 2024 Proxy Statement, Page 71:

Our Company has certain practices relating to the timing of grants of stock options. For option grants to our employees, including executive officers, grants of options are currently made by and at meetings of the Subcommittee on a predetermined schedule under our Share Incentive Plan. The Subcommittee does not currently take material non-public information into account when determining the timing and terms of stock option awards, except that if the Company determines that it is in possession of material non-public information on an anticipated grant date, the Subcommittee expects to defer the grant until a date on which the Company is not in possession of material non-public information. For option grants to our non-employee directors, as specified in the Director Share Plan such grants are automatically made on the date of each Annual Meeting to each non-employee director in office immediately following such meeting. See “Director Compensation” above. It is the Company’s practice not to time the disclosure of material non-public information for the purpose of affecting the value of executive compensation.

Intuit 2025 Proxy Statement, Page 60:

Equity grants made to the CEO, Executive Vice Presidents, or other Section 16 officers must be approved by the Compensation Committee.

Timing of grants. During fiscal 2024, equity awards to employees generally were granted on regularly scheduled predetermined dates. As part of Intuit’s annual performance and compensation review process, the Compensation Committee approves stock option, RSU and PSU awards to our NEOs within a few weeks before Intuit’s July 31 fiscal year-end. The Compensation Committee does not grant equity awards in anticipation of the release of material nonpublic information and we do not time the release of material nonpublic information based on equity award grant dates.

Option exercise price. The exercise price of a newly granted option (i.e., not an option assumed or substituted in connection with an acquisition) is the closing price of Intuit’s common stock on the Nasdaq stock market on the date of grant.

Visa 2025 Proxy Statement, Page 75:

The Compensation Committee maintains a Policy on Granting Equity Awards (Equity Grant Policy), which contains procedures to prevent stock option backdating and other grant timing issues. Under the Equity Grant Policy, the Compensation Committee approves annual grants to executive officers and other members of the Executive Committee at a meeting to occur during the quarter following each fiscal year end. The Board has delegated the authority to Mr. McInerney as the sole member of the Stock Committee to make annual awards to employees who are not members of the Executive Committee and who are not subject to Section 16(a) of the Exchange Act (Section 16 officers). The grant date for annual awards to all employees has been established as November 19 of each year.

In addition to the annual grants, stock awards may be granted at other times during the year to new hires, employees receiving promotions, and in other special circumstances. The Equity Grant Policy provides that only the Compensation Committee may make such “off-cycle” grants to NEOs, other members of Visa’s Executive Committee, and Section 16 officers. The Compensation Committee has delegated the authority to the Stock Committee to make off-cycle grants to other employees, subject to guidelines established by the Compensation Committee. Any off-cycle awards approved by the Stock Committee or the Compensation Committee are granted on the 15th day of the calendar month or on such other date determined by the Stock Committee, Compensation Committee, or the Board.

We do not grant equity awards in anticipation of the release of material, nonpublic information or time the release of material, nonpublic information based on equity award grant dates, vesting events, or sale events. For all stock option awards, the exercise price is the closing price of our Class A common stock on the NYSE on the date of the grant. If the grant date falls on a non-trading day, the exercise price is the closing price of our Class A common stock on the NYSE on the last trading day preceding the date of grant.

No off-cycle stock option awards were granted to NEOs in fiscal year 2024. During fiscal year 2024, we did not grant equity awards to our NEOs during the four business days prior to or the one business day following the filing of our periodic reports or the filing or furnishing of a Form 8-K that discloses material nonpublic information. We have not timed the disclosure of material nonpublic information for the purpose of affecting the value of executive compensation for NEO grants in fiscal year 2024.

Insight Industries + Practices

Sponsored Events

New York Intellectual Property Law Association’s (NYIPLA) 104rd Annual Dinner in Honor of the Federal Judiciary

March 27, 2026 | 6:30 PM – 10:00 PM ET

New York Hilton Midtown

1335 6th Ave, New York, NY 10019

Speaking Engagements

UNC Banking Institute

March 25 – 27, 2026

The Ritz-Carlton, Charlotte

201 E Trade St., Charlotte, NC 28202

Firm Events

Cross Border Life Sciences Distribution Agreements: A Trade Compliance Playbook

March 18, 2026 | 12:00 PM – 1:00 PM ET

Virtual

Webinars

Foreign Private Issuers’ D&Os Now Subject to Sec. 16(a) Insider Reporting: Compliance Burdens, Timing, Practical Implications

March 17, 2026 | 1:00 PM – 2:30 PM ET

Virtual