Articles + Publications March 20, 2023

SEC Comment Letter Update

Highlights of Trends in the 2022 SEC Comment Letters to Real Estate Investment Trusts

Overview

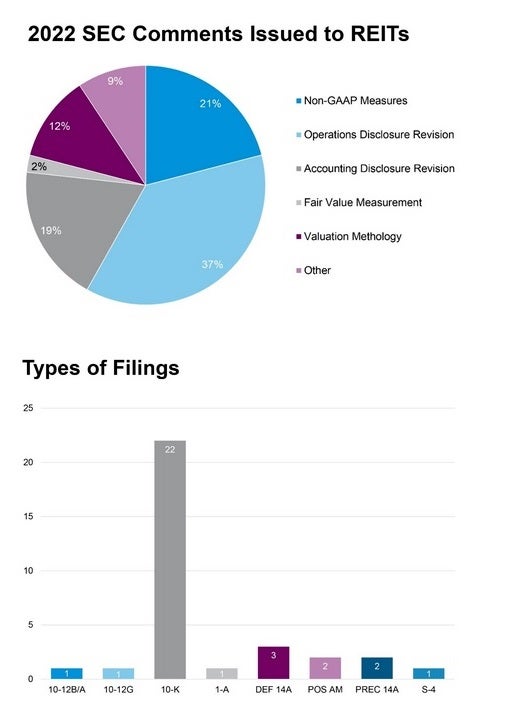

This article highlights comment letters publicly issued by the Securities and Exchange Commission (SEC) to Real Estate Investment Trusts (REITs) during 2022. The SEC issues comment letters in connection with its review of disclosures in public company SEC filings. In addition, the comment letter process signals trending SEC priorities. Comment letters often ask the subject public company to clarify (or revise) prior disclosures or make additional disclosures in future filings. Recently, the SEC has increased its focus on the use of non-GAAP financial measures. On March 14, the SEC settled an action for $8 million against DXC Technology Company. The SEC alleged DXC made misleading disclosures and lacked adequate disclosure controls about its non-GAAP financial performance measures in several quarterly and annual reports.

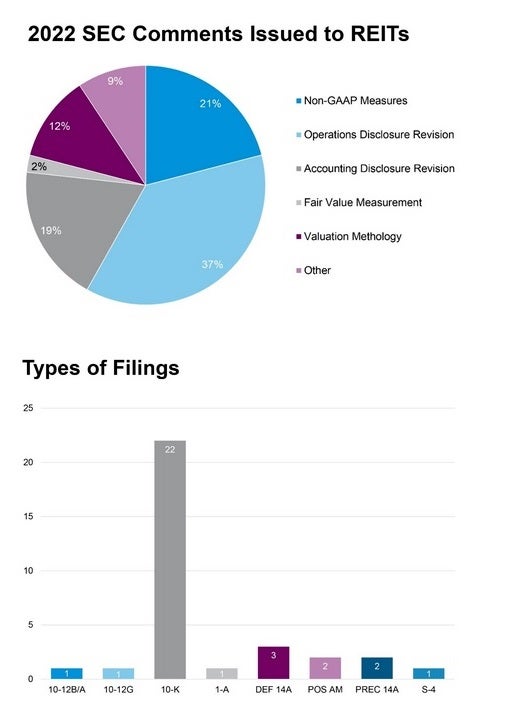

The SEC issued comment letters to 33 different REITs in 2022. A substantial majority of the comments were in response to registrants’ 10-K filings. The SEC staff’s comments continued to focus on non-GAAP financial measures and requests for additional accounting, operational, and valuation disclosures.

Key Takeaways

-

Comments regarding non-GAAP financial measures continue to be a heavy focus from SEC staff members. Registrants must ensure that any non-GAAP financial measure is coupled with a presentation of the most directly comparable GAAP financial measure and is displayed with equal or greater prominence.

-

“Core Earnings” and “Funds From Operations” were the two non-GAAP financial measures that received the most attention. To avoid comment letters, registrants should think critically about any adjustments made when presenting these measures.

Area of Focus

Non-GAAP Financial Measures

Non-GAAP financial measures, which are regulated by Item 10(e) of Regulation S-K and Regulation G, continue to be a primary area of focus in the SEC’s comment letters to REITs. Item 10(e) of Regulation S-K and Regulation G require that a non-GAAP financial measure be coupled with a presentation of the most directly comparable GAAP financial measure, along with a reconciliation of the differences between the non-GAAP and GAAP financial measure. Some of the SEC’s comments focused on Item 10(e)(1)(i)(A) and (B) of Regulation S-K, which requires the most directly comparable GAAP financial measure to be displayed with equal or greater prominence as the non-GAAP financial measure.

SEC Staff Comment: Non-GAAP Financial Measures – NOI

“We note that your disclosure under this heading references the reconciliation on page 72, which appears to be in the form of a full non-GAAP income statement. In future periodic filings, to avoid a non-GAAP prominence issue, please include a reconciliation that begins with the most directly comparable GAAP measure, which appears to be Net income, and reconciles down to NOI. Refer to Question 102.10 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations.”

In other comment letters, the SEC asked registrants to explain why they believed the GAAP financial measure was most directly comparable to the non-GAAP financial measure.

SEC Staff Comment: Non-GAAP Financial Measures

“We note that your non-GAAP measure ‘Economic net interest income from financial assets’ is reconciled to ‘Net operating income from financial assets determined in accordance with GAAP,’ which also appears to be a non-GAAP measure. Please show your presentation is consistent with Item 10(e) of Regulation S-K; specifically, tell us how you determined that you have reconciled ‘Economic net interest income from financial assets’ to the most directly comparable GAAP measure.”

SEC Staff Comment: Non-GAAP Financial Measures – NOI

“We note your presentation of the non-GAAP financial measure Net spread and dollar roll income and further-adjusted measures, reconciled from Net interest income as the most directly comparable GAAP financial measure. Given the inclusion of total operating expense as a component of these measures, it appears these measures are more akin to an operating measure. Therefore, please tell us why you believe Net interest income, which contemplates only expenses used to fund your interest-earning assets is the most directly comparable measure calculated in accordance with GAAP. In your response, specifically address your consideration of Net income or similar measure calculated in accordance with GAAP as the most directly comparable measure to the non-GAAP financial measures addressed herein.”

The SEC also commented on filings that did not disclose why the registrant’s management believes the presentation of the non-GAAP financial measure provides useful information to investors regarding the registrant’s financial condition and results of operations, as required by Item 10(e)(1)(i)(C) of Regulation S-K.

Area of Focus

Core Earnings Metric

Core Earnings is a non-GAAP measure that continues to attract attention from the SEC. Core earnings, or similarly titled measures, reflect adjustments to GAAP earnings (or further adjustments to a previously defined non-GAAP financial measure of earnings) that vary across companies and commonly eliminate unusual or nonrecurring income and expense items. The SEC commented on filings where Core Earnings included an adjustment for realized and unrealized gains and losses, as well as adjustments for various changes in fair value of mortgaging servicing rights, long-term debt, and net trust assets, all of which the SEC viewed as being central to the nature of the registrant’s business operations.

SEC Staff Comment: Core Earnings Metric

“We note your disclosure of Non-GAAP Core Operating Income. This non-GAAP measure include an adjustment for various realized and unrealized gains and losses. In light of this adjustment, please tell us how you determined it was appropriate to title this measure as core operating income.”

“We note your disclosure of core (loss) earnings before tax. This non-GAAP measure includes adjustments for various changes in fair value of financial assets and liabilities such as mortgage servicing rights, long-term debt, and net trust assets. As a residential mortgage lender which originates, sells and services residential mortgage loans, it appears such fair value adjustments are central to the nature of your business operations. Please tell us how you determined it was appropriate to label such a measure as “core” earnings. In addition, please tell us and expand upon your existing disclosures to further describe the usefulness of and how management utilizes this measure to assess performance.”

Area of Focus

Funds From Operations Metric

One comment that appeared in multiple letters concerned the definition of Funds From Operations (FFO). FFO is widely used by REITs and generally is presented in accordance with NAREIT’s definition. Often companies will present FFO, as further adjusted, and these further adjustments need to be presented with precision, consistency (i.e., across periods), and reconciliations.

SEC Staff Comment: Funds From Operations Metric

“We note that you have included an adjustment for provision for credit losses to arrive at your measure titled FFO attributable to Bluerock Homes. As a result of this adjustment, it appears that your computation of FFO differs from the NAREIT definition of FFO. Please revise the title of this non-GAAP measure to distinguish it from FFO as commonly defined or remove the adjustment. Further, please update the related disclosure of this measure, as appropriate.”

SEC Staff Comment: Non-GAAP Financial Measures

“Please tell us how your definition of FFO is consistent with the NAREIT definition of FFO. Specifically, tell us how you have determined it was appropriate to exclude foreign currency transaction loss from your definition of FFO for the period ending December 31, 2021.”

Area of Focus

Net Asset Value Calculations

The SEC requested additional disclosures on net asset value (NAV) disclosures, including discussion of the methodologies used to calculate NAV, the underlying assumptions applied, and the frequency at which a new NAV was calculated.

SEC Staff Comment: Net Asset Value Calculations

“Expand your disclosure to include a discussion of the methodologies used to calculate net asset value. Tell us whether your calculation of property fair value includes any other material assumptions (e.g. revenue or expense growth rates) and tell us what consideration you gave to providing disclosure about these assumptions (including sensitivity analyses).”

SEC Staff Comment: Net Asset Value Calculations

“Please address the following with respect to your net asset value disclosures: Please expand your disclosure to include a discussion of the valuations policies used to determine net asset value. Your revised disclosure should include a discussion of the significant assumptions to determine the value of assets and liabilities, a sensitivity analysis for any significant assumptions used in your calculation, the entities responsible for determining net asset value and the frequency with which a new asset value is determined. It appears that you include loans receivable, collateralized loan obligation, and credit facility payable at book value and not fair value when calculating NAV. Please expand your disclosure to include a discussion as to why these items are not included in NAV at fair value, and to the extent practical also disclose the fair value of these items for comparability purposes.”

Area of Focus

Proxy Statement: Lead Independent Director and Risk Oversight

The SEC provided the same comment to three different issuers on their proxy statement (Form DEF14-A) related to leadership structure and the lead independent director’s experience as it relates to the board’s role in risk oversight. The issuers resolved the SEC’s comment by promising to enhance future proxy disclosures.

SEC Staff Comment: Proxy Statement: Lead Independent Director and Risk Oversight

“Please expand your discussion of the reasons you believe that your leadership structure is appropriate, addressing your specific characteristics or circumstances. In your discussion, please also address how the experience of the Lead Independent Director is brought to bear in connection with your board’s role in risk oversight.”

Area of Focus

Post Chapter 11 Bankruptcy

One registrant who recently emerged from Chapter 11 bankruptcy received a comment letter regarding its use of a predecessor’s financial statements. The financial statements prepared by an entity emerging from the Chapter 11 bankruptcy process are considered “fresh-start” financial statement and therefore are not comparable to financial statements of the registrant before entering bankruptcy proceedings.

SEC Staff Comment: Chapter 11 Bankruptcy

“We note that you have combined your results of operations for the predecessor and successor periods during 2021 throughout your MD&A, including, but not limited to, your discussions of results of operations and your calculation and discussion of your non-GAAP measures. Given that fresh-start financial statements prepared by entities emerging from Chapter 11 are, in effect, those of a new entity, and thus not comparable to prior period financial statements, please tell us how you determined this presentation was appropriate.”

Chapter 11 Bankruptcy

The SEC also issued another comment to the same registrant above regarding post-bankruptcy valuation. As discussed above, the SEC has emphasized the need for disclosures surrounding valuation policies. While containing similarities to a comment letter focused on valuation, this example gives insight into what the SEC is looking for when considering valuation in the post-bankruptcy environment. Registrants should ensure their methodologies are properly disclosed, particularly methodologies for determining terminal value, discount rates, tax rates, and the duration for cash flow projections.

SEC Staff Comment: Chapter 11 Bankruptcy

“Please revise your disclosure in future filings to include more detailed information regarding your determination of the reorganization value, including all of the following:

• The method or methods used to determine reorganization value and factors such as discount rates, tax rates, the number of years for which cash flows are projected, and the method of determining terminal value[;]

• Sensitive assumptions — that is, assumptions about which there is a reasonable possibility of the occurrence of a variation that would have significantly affected measurement of reorganization value; and

• Assumptions about anticipated conditions that are expected to be different from current conditions, unless otherwise apparent[.]”

Miscellaneous Comments

Ownership and Organizational Structure Diagram – Registrants must include a diagram depicting their ownership structure when filing a Form 10-12G. One registrant received a comment because it did not include an organization structure of the UPREIT after a spin-off transaction.

SEC Staff Comment:

“Please revise your disclosure to include a graphic depiction of the organizational structure of Bluerock prior to the spin off transaction and its UPREIT structure after the spinoff transaction so that investors may better understand the details of the spin off.”

Significant Subsidiaries – A significant subsidiary’s financial statements must be filed with the Registrant’s Form 10-K, as opposed to referencing a prior filing of the financial statements.

SEC Staff Comment:

“We note your disclosure that SAFE represented a significant subsidiary of the Company and your reference to their financial statements on the website of the Securities and Exchange Commission. Please tell us how you determined it was not necessary to file such financial statements with your Form 10-K. Please refer to Rule 3-09 of Regulation S-X.”

Disclosing Factors with a Significant Impact on Operations – Registrants must confirm that financial statement disclosures align with operational disclosures. For example, registrants must discuss the operational impact of new assets that were added to financial statements.

SEC Staff Comment:

“Please consider expanding your disclosure to quantify all the factors that had a significant impact on operations from period to period. For example, we note that the completion of a global development pipeline, expansion into new markets in EMEA and property sales all contributed to the change in non-stabilized rental and other services revenue during the period. However, it does not appear that the impact of these items has been quantified in your MD&A.”

Insight Industries + Practices

Sponsored Events

New York Intellectual Property Law Association’s (NYIPLA) 104rd Annual Dinner in Honor of the Federal Judiciary

March 27, 2026 | 6:30 PM – 10:00 PM ET

New York Hilton Midtown

1335 6th Ave, New York, NY 10019

Speaking Engagements

UNC Banking Institute

March 25 – 27, 2026

The Ritz-Carlton, Charlotte

201 E Trade St., Charlotte, NC 28202

Firm Events

Cross Border Life Sciences Distribution Agreements: A Trade Compliance Playbook

March 18, 2026 | 12:00 PM – 1:00 PM ET

Virtual

Webinars

Foreign Private Issuers’ D&Os Now Subject to Sec. 16(a) Insider Reporting: Compliance Burdens, Timing, Practical Implications

March 17, 2026 | 1:00 PM – 2:30 PM ET

Virtual